After being in the real estate industry for such a long period of time, we’ve heard various reasons from clients as to why now isn’t a good time for them to buy. One of the most common excuses we hear from people is that they are waiting for prices to go down… don’t fall victim to this strategy!

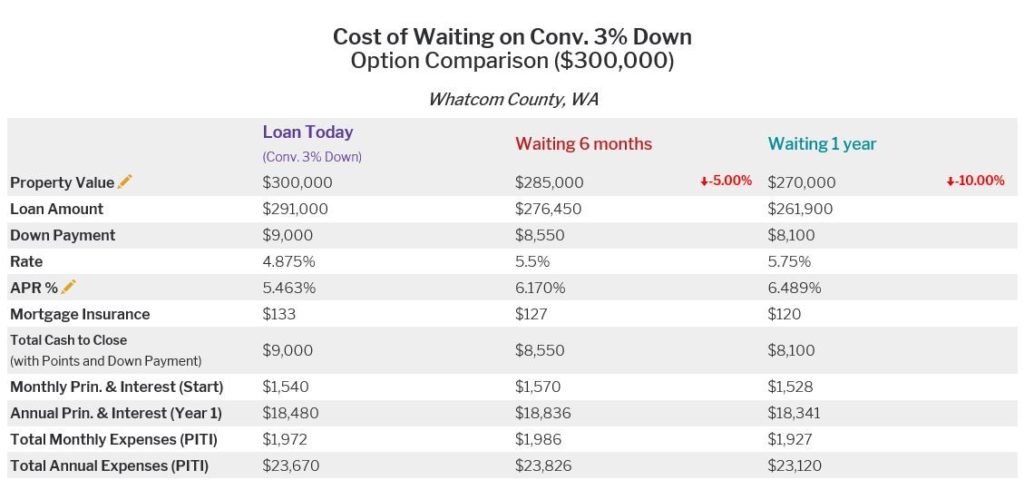

We understand the thought behind this decision, and it makes sense theoretically. However, there are other factors at play that make the waiting game not very beneficial at all. One important factor being fluctuation in interest rates. What if prices drop but interest rates increase? Take a look at the table below to find out if you really will be saving money by waiting.

The example above shows that even if prices were to drop 5% in 6 months and even 10% in a year, rates are projected to rise in the near future. Conclusively, if prices drop 5-10% with rates increasing, there will be little to no savings in your monthly mortgage payment.

It is our duty to ensure our clients are educated when it comes to buying a home, and we don’t want you to be mistaken when it comes to potential market changes. Currently, mortgage rates have reaches the lowest levels in over two years, and we encourage you to consider locking that rate in if you’ve been on the fence about buying a home!

We also recommend meeting with a reputable loan company such as Caliber Home Loans to discuss your qualifying options! One of their managing loan officers, Casey Porter works here at our office part time, and we couldn’t commend him enough for the care he shows our clients from the beginning stages to getting the keys to their new home. Let’s set up a meeting with Casey, and get you closer to finding the home you’ve been waiting for!

Give us a call if you’d like more information about this, and find more on Casey Porter HERE.